Renters Insurance in and around De Pere

Your renters insurance search is over, De Pere

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

It may feel like a lot to think through keeping up with friends, your busy schedule, your sand volleyball league, as well as providers and deductibles for renters insurance. State Farm offers hassle-free assistance and unbelievable coverage for your electronics, sound equipment and furnishings in your rented condo. When the unexpected happens, State Farm can help.

Your renters insurance search is over, De Pere

Renters insurance can help protect your belongings

Why Renters In De Pere Choose State Farm

You may be wondering: Do you really need renters insurance? Imagine for a minute the cost of replacing your stuff, or even just a few high-cost things. With a State Farm renters policy behind you, you don't have to worry about fires or break-ins. Renters insurance doesn't stop there! It extends beyond your rental space, covering personal items you've left in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. As more of your life is online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Zach Zimmerman can help you add identity theft coverage with monitoring alerts and providing support.

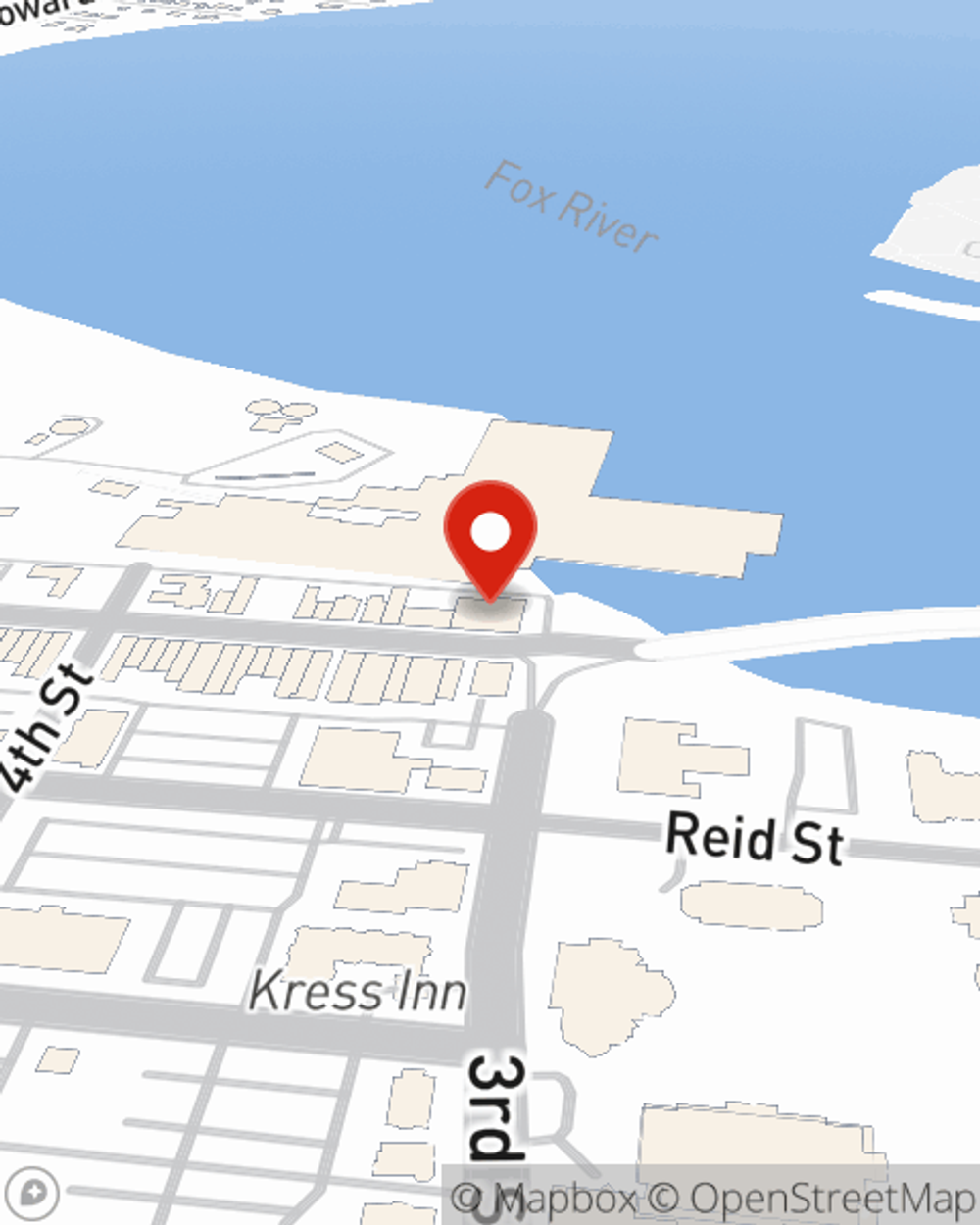

As a value-driven provider of renters insurance in De Pere, WI, State Farm aims to keep your valuables protected. Call State Farm agent Zach Zimmerman today for a free quote on a renters policy.

Have More Questions About Renters Insurance?

Call Zach at (920) 351-4031 or visit our FAQ page.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Zach Zimmerman

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.